On Thursday, July 18, Dele wrote an open letter to President Tinubu in which he expressed concern about the status of the country, citing the flagging economy in particular.

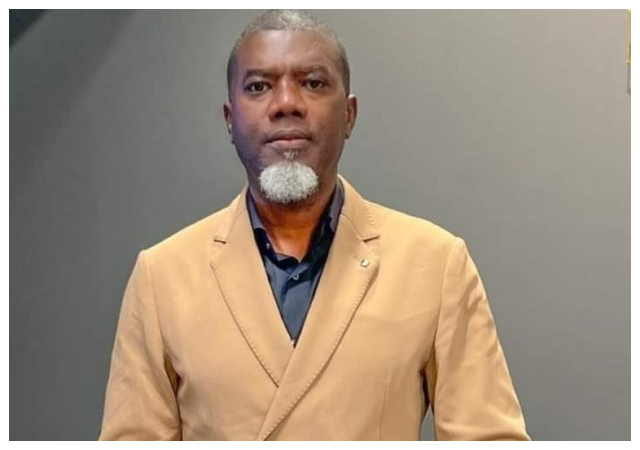

Reno made the case that the Nigerian economy is solid in a post that was posted on X. He then listed a few examples to support his claim.

He wrote;

Response to My Beloved Senior, Dele Momodu: Nigeria’s Economy Is Not Collapsing. Far From It!

Dear Egbon Dele Momodu,

I read your open letter to President Bola Tinubu, in which you said, “Our economy has virtually collapsed”, among other things. Respectfully, the facts do not support your assertions, and in your open letter, you did not provide any facts. Only opinions. So, please let me present some facts that contradict your opinions.

Firstly, only yesterday, the International Monetary Fund projected that due to the reforms being undertaken by the current administration, Nigeria will have a 3.1% GDP growth rate in 2024. This is one of the best projections for an African country in 2024, and does not signal an economy that has ‘virtually collapsed.’

Secondly, Nigeria had a record high of ₦6.52 trillion trade surplus in the first quarter of 2024. This has never happened before. We routinely had trade deficits in the past. This means that because of the monetary reforms by the current government, Nigeria is now exporting significantly more than it is importing, and the growth is largely in the non-oil sector.

For example, Nigeria is now a net exporter of clement to Europe and a growing exporter of refined petroleum products to Europe and West African states. Ghana, a fellow petroleum exporting country, is largely dependent on LPG from Nigeria. This projects growth, not collapse.

Thirdly, in terms of revenue, all Nigerian states, bar none, have received significantly higher federal allocations since May 29, 2023, than they were receiving under the Buhari regime. Each state now gets at least 45% more federal allocation, with Nasarawa getting almost 100% more and Anambra getting 70% more, whereas their wage bill has not increased.

The above projects economic strength rather than collapse.

Fourthly, according to Financial Derivatives (FDC), with a Return on Investment of 22.90%, Nigeria’s Stock Exchange is now the most profitable capital market on Earth, bar none. Please note that. Bar none. The National Bureau of Statistics has also corroborated this. For the first time in our history, the all-share index (ASI) of the Nigerian Stock Exchange crossed the 100,000 mark in 2024.

I would not categorise such growth as collapse, and I am sure investors who smiled to the bank would not either. Fifthly, capital inflow into Nigeria increased by 66.27% this year. This is probably w